New Fortress Energy - 2023 Assessment and 2024(+) Outlook.

You’re not crazy; the market just can’t see the fortress for the trees.

The Proven Reserves Desk for Perplexing Price Action is a group of poor and unfortunate souls tasked with determining what exactly will gets a market participate to buy or sell an equity. We often hear their screams and rants of frustration: recently a memo released from PPA desk that made a strong argument that it’s more likely humanity will develop warp drive before philosophers solve the vexing puzzle of secondary market price action.

Strong Results from Q4

For the full year, Operating income was up massively YoY increasing over 200 million dollars. The cadence for what we think is to come is best shown in the QoQ from 3rd quarter to 4th quarter: for a 244 million increase in revenue, operating costs only increased 74 million. That is an incredible result, and showcases better than anything else the power of the vertically integrated business model and the earnings power NFE can deliver on. This also occurred in quarter where natural gas prices at Henry Hub declined 33% from Oct 27th to Dec 28th, with TTF declining near 43% over the same period.

But what can you do? A strong beat of analyst expectations, and management guiding up earnings expectations for 2024, has been met with been met with lowered price targets and downgrades. At Proven Reserves, we love when it sell side becomes ‘SELL’ side, but for whatever reason, as of the time of this writing, NFE 0.00%↑ has effectively round tripped off earnings. Rising 11% off earnings, and then selling off 2.05 and 6.36%.. What exactly does the market want?? At the current price, NFE is trading at effectively 6 times forward earnings. This is the bargain for a infrastructure enterprise with a seemingly never ending fountain of growth.

Let’s review this growth: since 2021, NFE has managed to increase bottom line earnings to 2.65 cents from .47 a share , and revenue to 2.337 billion from 1.161 billion. They are forecasting 5+ EPS for 2024 and revenue at nearly 4 billion.

Brazil - The fortress.

The Santa Catarina and Barcarena terminals now operational in Brazil as of March 1st and Feb 29th, will be a strong driver of not only additional revenue for 2024 and beyond, but with mountains of capacity, new business deals as well.

Barcarena itself, with a 30 Tbtu supply agreement with Norsk Hydro, and 630 MW of power plant coming online next year, and 1.6 GW in the year after that, represents additional top line revenue of ~2.47 billion annually (2023 full year revenue was 2.4 billion, company wide), just that alone! And this is operating at just 26% of the terminal capacity.

FLNG 1 - Lower Costs.

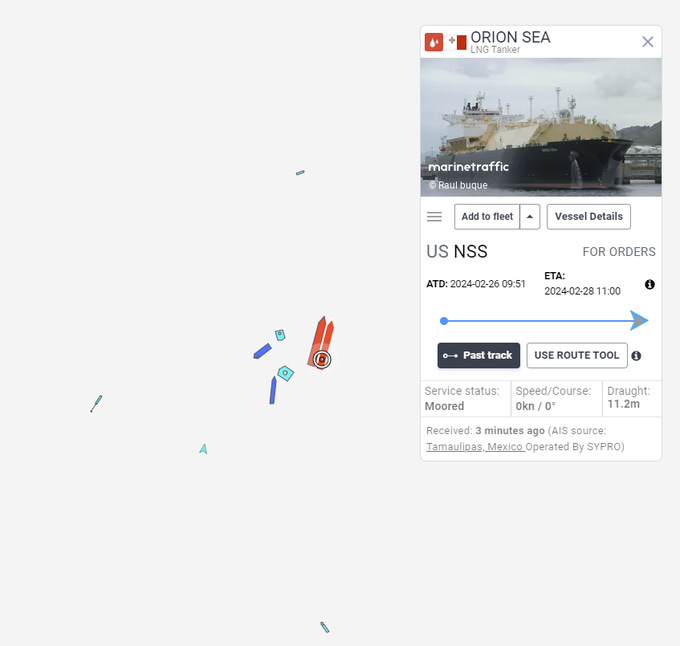

Is happening, finally, and sooner rather than later. On Monday, 4th of March, the LNG carrier Orion Sea departed from FLNG 1. We believe this was to prime the system by delivering the “heel” to NFE Penguin, the FSU moored at FLNG 1. The heel is required for LNG carriers to keep the LNG cool once it’s in tank. Liquefication/production of LNG should begin imminently. This will provide a solid supply of low costs LNG for NFE and the operating flexibility that comes with it.

BUT PUERTO RICO?! - What about it?

Much ado is being made about FEMA wanting to wind down it’s current relief operation in PR and some analysis who can’t see the fortress for the trees are worrying a bit much about nothing. One, any early contract termination is going to come with termination payments, and should the government of PR decide to buy them, NFE will receive fair value for the power plant assets it current owns at Palo Seco and San Juan Fast Power.

Beyond that, Puerto Rico can either keep running on expensive diesel/HFO power or it can switch more generating assets to LNG/natural gas. The cap on LNG prices is effectively the cost of diesel, as this is the first alternative in terms of generating sources and cost. And NFE owns the only material terminal for importing that LNG into PR, and will continue to maintain their contract for thermal asset management via GeneraPR for the next 10 years.

As management pointed out on the earnings call, there is tons of potential business in PR, and they remain committed to operating there. Once more - the power plant assets are something that the current PR government wants to keep operating, as it is providing desperately needed power to the island, operating nearly non-stop at 97% capacity factory since coming online.

We are taking view this Puerto Rico scenario that some analysis see as MASSIVELY overblown and borderline nonsense. What exactly is the alternative? No power? That doesn’t seem very plausible.

Even losing Puerto Rico, you still have La Paz, Jamaica, and Brazil, the latter we expect to provide well over half of NFE’s revenue by 2026.

Debt.

This is something that does absolutely need to be addressed.

And to be sure, this announcement probably didn’t help the recent price action. But NFE is very capex heavy enterprise, and as long as the growth continues at this current pace, this is more sustainable that issuing debt because revenue isn’t covering mature operations. To that, there is a substantial current liabilities that need to be paid, including 292.6 million in debt. To raise funds for this, NFE has sold off their stake Energos, the enterprise they lease their ships back from, as well this debt offering proposal.

Overall, the debt and other obligations does affect the price target, and is balanced with the strong growth. As of this writing, NFE is trading at 6 times forward earnings, well below where a company like NFE should be trading at. It’s very common for infrastructure utilities to trade at 20 times earnings. With cash flow from operations at nearly 824 million from 2023, nearly tripling from 2022, coupled with the continued increase in bottom line earnings, it’s not hard to concluded that 10 times forward P/E is a warranted price here. At 6 times, this would price NFE at 60 dollars. Let’s just cut that down to $57.64 per share, the all time high and call it a day.

- Chapman