The market is a wild bronco at times, it rarely does exactly what you think it will do. The only thing you can be sure of is the market will test your resolve.

But the bond market is still rallying. The spot price of U308 is at the time of this writing up 4.1% from July.. and still down ~20% from March highs. No news that Cameco’s Port Hope conversion facility is at capacity. No announcements, or even a rumor, on a new high in the term price; or frankly any new information in the movement on term pricing.

But here at Proven Reserves, the analysis is based on solid fundamentals. It is unfortunate that those fundamentals simply do not support the recent price action.

And without solid fundamentals, the Proven Reserves Risk Analysis and Mitigation Desk feels that investors may want to take a moment and look at the big picture. Effectively, the uranium market is rallying *solely* on narrative. Like sailing in a hurricane, the winds of that narrative can change at any moment..

While it can be said that these recent events all started with reports of Japanese restarts and the market believing that this was going to be a major boon for the uranium market - here is the reality:

Of the 54 reactors in Japan, the following is the status: 24 are being decommissioned, and of the remaining 30 reactors, at present, 9 have been restarted, with the rest (21) in various stages of planning for restarts, along with the upgrades to satisfy the regulatory hurdles. For these reactors, based on the current inventory of enriched uranium as of Dec 31st, 2021, ~10 years of inventory. This data comes from a report from the Atomic Energy Commission of Japan. PLEASE NOTE - This report was released in March of 2022.

Since you want the above translated.

With over 17,392 metric tons of enriched uranium (and a not insignificant amount of plutonium than can make MOX fuel in a pinch), Japan actually presents a more bearish factor for uranium in a bifurcated market, their enriched uranium will have a FAR higher value than it was in the past.

PLEASE NOTE - In the previous analysis for Bull Thesis Mark II, it was assumed that the Japanese did not have this level of inventory, as for one, the analysis was based on inventory sustaining levels of production and enrichment required, and to be frank, the inventory figures were simply unknown at the time. This will be corrected to show updated figures ASAP, while the change is material, it does not preclude a bull case for uranium.

While it was speculated that the Japanese may sell their uranium inventory, as was reported in Reuters in 2019.

It is important to note, that the sales at the time were small, and being well below the values that the uranium was purchased for, simply considered not worth it to sell more. It was known at the time that the Japanese had a VERY large inventory of fuel, as seen below chart breaking down the inventory levels on a per utility basis.

Above we see the 2019 inventories and below, is the balance sheet for Hokkaido Electric Power company for June 30th, 2022.

Above, we see that 231,963 million yen of nuclear fuel was reported on the balance sheet. This numbers appear to closely match with what appears to be just under 250,000 million yen reported in Reuters in 2019.

Based upon the report from the Japanese Atomic Energy Commission, inventory data reported by Reuters in 2019, and the Balance Sheet from Hokkaido Electric, the Proven Reserves Inventory Analysis Desk believes this presents VERY strong evidence of the inventory levels of Japanese nuclear utilities. Effectively, the Japanese restarts, and even a few new builds, are going to have very little, and certainly not a material impact, on a bull market for Uranium.

Looking deeper at these inventories, it is interesting to note that the average enrichment level appears to be 2% enriched U-235. On it’s face, this would appear to be far lower than than we would expect for reactor fuel, however the Japanese, more so than any other OCED operator, has historically favored boiling water reactors. In a BWR, the fuel is in fact not loaded at a more uniform assay like a PWR, but in fact, a higher assay core, that is blanketed by a lower assay fuel: in the example below, natural uranium in fact.

While it is immaterial to the broad market, the Japanese have a small domestic enrichment capacity of ~1.25 million SWU per year. This is sufficient to the Japanese historical needs to enrich some of their uranium to a higher assay for their BWR reactors. While this has not been confirmed, it would appear that the historical order patterns for the Japanese would be to procure uranium at a lower enrichment level, and then enriched it to their required needs using their domestic capacity.

How did the market get this so wrong?

Well, the Proven Reserves Market Psychology Analysis Desk believes that a strong case of confirmation bias without the appropriate levels of due diligence is at fault. One can note the recent interview on BNN Bloomberg with the CEO of Cameco Tim Gitzel. While the topic of the interview was the news of the additional 7 units the Japanese government wants to see restarted by next summer, the only thing that Tim said directly addressing the Japanese market was “We have a team on the ground this week, talking to customers about their future needs”, which says nothing other than ‘we have people that speak Japanese’.

In fact, going back over the interview, it seems that CEO Gitzel actively tries to avoid what impact the Japanese restarts will have for Cameco. After not really answering it even when asked directly, he only gave the above quote after it was pointed out that Cameco was planning on restarting McArthur River even before these restarts were announced.

The broad market also asked no questions about why there has not been word from a single Japanese utility about fuel needs. More troublingly, there have been no questions concerning the fact that the Japanese are able to restart 7 reactors within 9 months without making a single order for new fuel or uranium of any kind; even when it commonly known that normally this process takes at least 2 years.

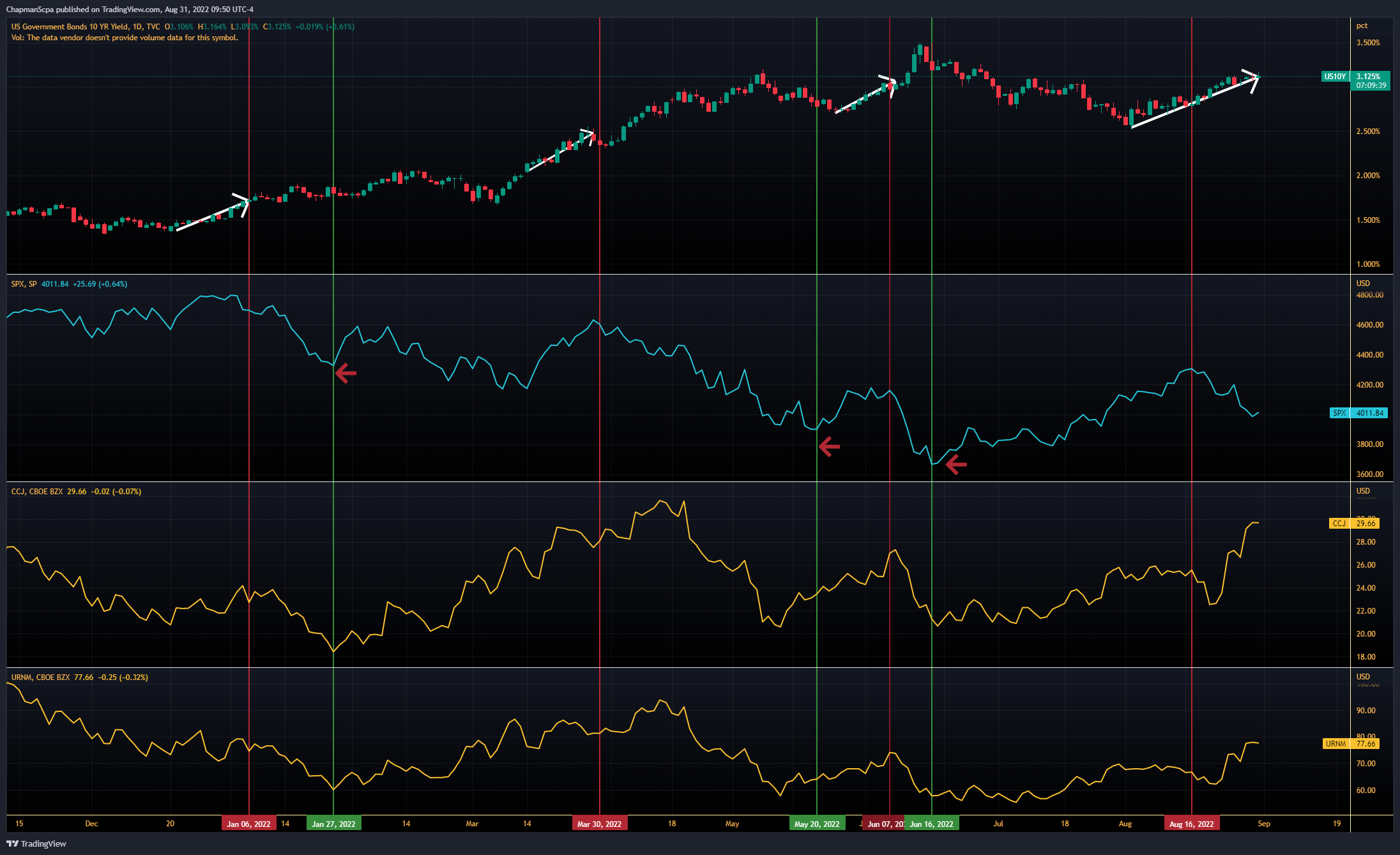

Concerning the broad markets, here is what the Proven Reserves Market Dynamics Analysis Desk believes is occurring. Generally speaking, when the US10yr yield in the bond market is going up at a greater rate than the SP500, this has been a strong signal that the broad market is about to turn to a bear trend (red bars), following by a lower low and reversing back to a bullish trend when the yields in the US10yr pivot to a bearish trend (green bars).

In January and June of this year, Uranium equities generally traded down with the broad market, but in late May, briefly rallied against the bearish broad market before turning bearish as well and selling down with the rest of the market. Given that this recent rally is based on a narrative (that has no basis in reality) rather than solid fundamentals, it is up to you to decide if you conclude the market is about to turn to a more bearish trend.

The Proven Reserves Capital Allocation and Acquisition Planning Desk will be operating under a bid-discipline strategy, and will not chase a bullish trend that lacks the fundamental foundations. Patience is a virtue.

- Chapman.

As always, the disclaimer: Just remember - I am not your fiduciary, so all investments and your decisions concerning such that you choose to make are at your own risk.

From what I’ve heard/read, the bullish thesis around the Japan decision is based on the fact that they will no longer be selling their significant U holdings to the market. This has taken away an expected future supply.

It takes guts to be contrarian, keep it up! Just because all run in on direction it does not mean, they are right.